The meatless industry is growing at a rapid rate, thanks to a worldwide shift in consumer behavior. More consumers are jumping onto the bandwagon of the plant-based food category and over the last couple of years, meatless burger patties have been a clear winner at several fast-food chain restaurants. It is forecasted that in the next ten years, the meatless market will grow to a whopping $140 billion industry. Market leaders Impossible Foods™ and Beyond Burger have been responsible for the quick adoption of meatless alternatives, with Beyond Burger’s™ shares increasing by almost 600% in 2019. It is but natural that such a growing market would soon see a lot of competition. Here is how the landscape looks.

Top 4 Competitors of the Leaders

The initial lion’s share of Impossible Foods and Beyond Market is now being challenged by a greater number of reputed and new brands alike. Here are the top 4 competitors.

Nestlé™

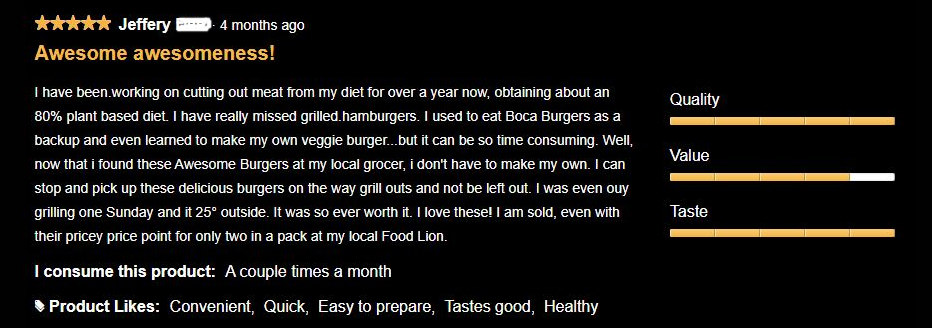

When it comes to packaged foods, Nestle has always been one of the household names. They are not shying away from marketing their recently launched meatless burger patties either. Named ‘Awesome Burger™’, this patty from Nestle is based on pea-protein and is available in the American market under the brand name ‘Sweet Earth’. This is Nestle’s meatless brand. The brand is not new to the meatless industry, though. It has previously launched a soy-based item called ‘Incredible Burger’, which was made available through McDonald’s in Germany. Nestle continues to innovate and improve. Its subsidiary in the US, Sweet Earth Foods™, is launching a new and improved version of plant-based patties under the name of “Awesome Burger™.” Judging by the reviews on Sweet Earth Foods’ website, Nestle’s new and improved meatless burger is well received in the US.

Sysco™

At the beginning of 2020, Sysco Corporation™, which is a large foodservice distribution company, launched its range of plant-based meatless burger patties, to be sold under the brand name Sysco Simply. This wing of the company caters to consumers with flexible food choices. It is a perfect competitor for the meatless patty by Impossible Foods as it promises a meat-like texture, much like the mimic burgers by the industry leader. It even amps up the quality of the burger by claiming to use non-GMO and gluten-free ingredients. To compete further, Sysco offers a ground meatless option so that customers could themselves shape their patties, nuggets, and so on.“One of the key features of the patty is the special spice blend,” said chef Neil Doherty, Sysco senior director, culinary development. “We worked extensively to ensure that we got the recipe just right. Our juicy Sysco Simply burger, with its exclusive combination of flavorful seasonings, has a hearty, meat-like texture and cooks within minutes, just like a traditional burger.” Feedstuffs™ reports. New versions of meatless patties made by food giants like Sysco will certainly awaken the competitive drive in other plant-based startups, which in return will result in a better tasting burger patty.

Kellog™

Kellog™ is one of the largest food manufacturing companies in the US and has a fair market share worldwide as well. When you think of breakfast cereal, Kellog™automatically comes to the mind. It is no surprise then that they would, too, venture in the meatless market. Kellog’s meatless burger patties and other faux meat products are available through its plant-based division, Morningstar Farms™. The division is worth $3 billion and a third of its sales are generated from meatless burger patties. The brand was already doing well with plant-based veggie dogs and nuggets and now has launched a new product range called Incogmeato Ready-to-cook meatless burger patties form the star attraction of this range. “As more consumers are choosing a ‘flexitarian’ lifestyle and actively reducing meat, we’re thrilled to be extending the Morningstar Farms portfolio with a delicious and satisfying meat-like experience, said Sara Young, general manager of the Morningstar Plant-Based Proteins Department.” USA Today reports. A very popular plant-based item by Morningstar Farms are the Original Sausage Frozen Patties™

Tyson™

What happens when one of the largest meat product manufacturers invest in plant-based alternatives? The competition becomes even more fierce. Tyson Foods™ had previously invested in Beyond Meat™, but soon sold their shares and came up with their in-house plant-based division instead. Called Raised & Rooted™, this division brings to the market vegan burgers as well as combination products. These combination products contain both meat and plant-based protein and are targeted at consumers who are ‘flexitarian’. In a way, for meat-eaters, this is a boon because it makes the transition from 100% meat products to 100% plant-based products a lot smoother.

Response from the Leaders

It is but inevitable that in a free market society, any new category of a product would be met with fierce competition. With growing alternatives, market prices often tend to decrease as more brands strive to be the number one choice of the target market. In such a scenario, the pioneers of the field cannot simply sit back and relax. They need to continue to innovate to hold their market share and grow beyond the competition.

That is exactly what the meatless market leaders Beyond Meat™ has been doing. They launched version 2 of its famous meatless burger with a rawer look and a coarser texture. They invested in research and came up with different ingredient combinations to achieve a patty that would be more appealing to the masses. Its direct rival Impossible Foods is not far behind, either. Recently, they announced an expansion to global markets with their newly launched meatless ground pork and sausages. Diversity has been a top priority for this company.

What the Future Looks Like

Although the meatless industry is still significantly small compared to the meat industry, it is growing at a rapid rate. “Regardless of the hurdles to a meatless future, alternative meat products are clearly diversifying and growing, capturing investors and public attention alike. “CB insights reports. Some consumers are still reluctant to pay extra for plant-based alternatives, even though they understand the benefits. However, the landscape is expected to change quickly in the future as competition in this food category begins to heat up. With more options, brands would be forced to lower their prices to reach more consumers. Additionally, as companies continue to experiment with new ingredients, the quality of the meatless burger patties and other meatless products is likely to improve. A quick worldwide uptake of this revolutionary product category will then become a reality. Take a listen to the audio interview bellow, courtesy of National Public Radio.